Present value of deferred annuity calculator

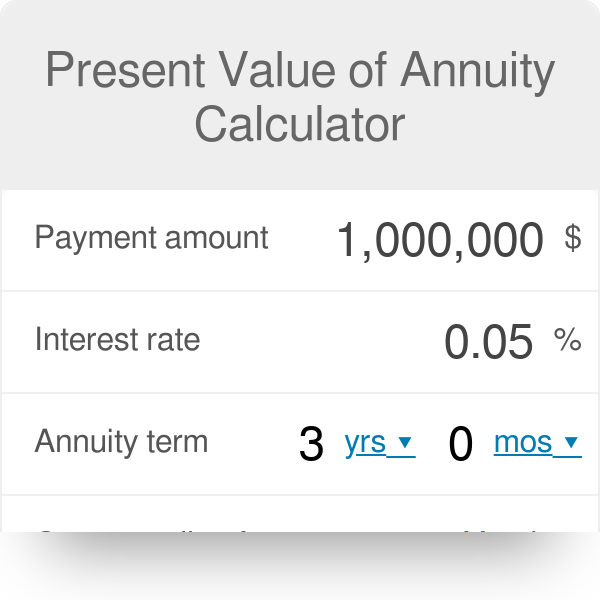

The present value is given in actuarial notation by. Number Of Years To Calculate Present Value This is the number of years over which the annuity is expected to be paid or received.

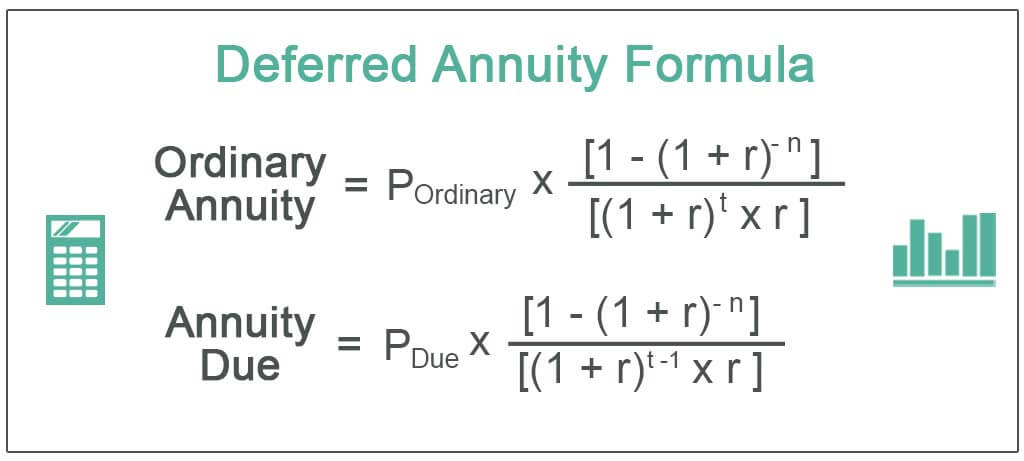

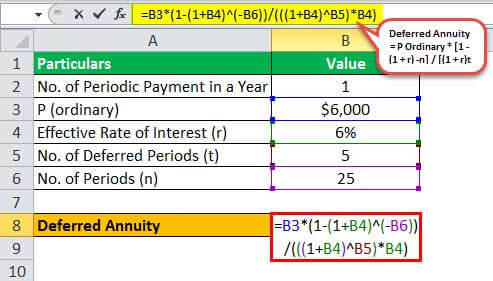

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Calculating the Future Value of an Ordinary Annuity.

. Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. Present value is linear in the amount of payments therefore the. Tax-Deferred Annuity Tax-Deferred Annuity A tax-deferred annuity is an employee retirement benefit plan where both an employer and its employee.

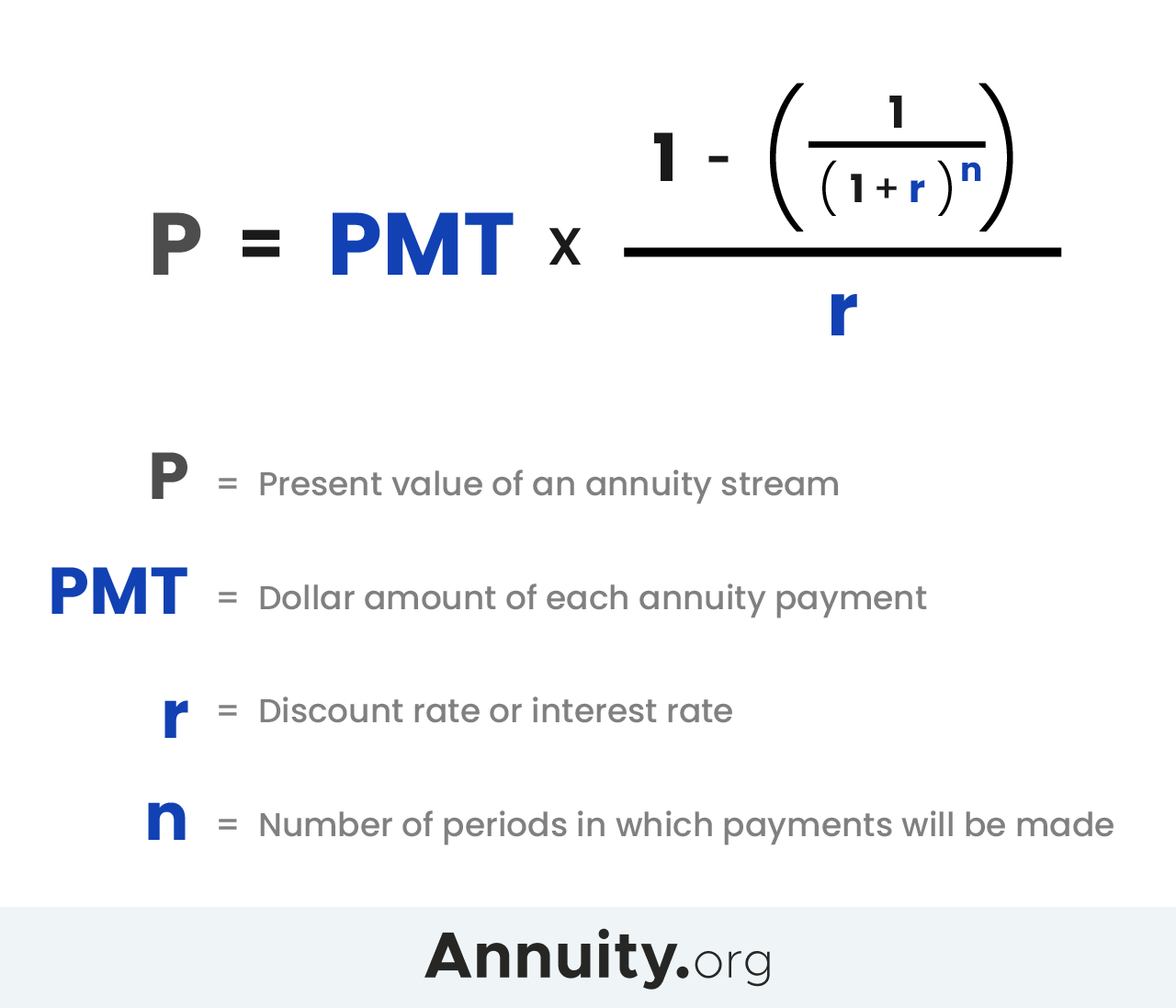

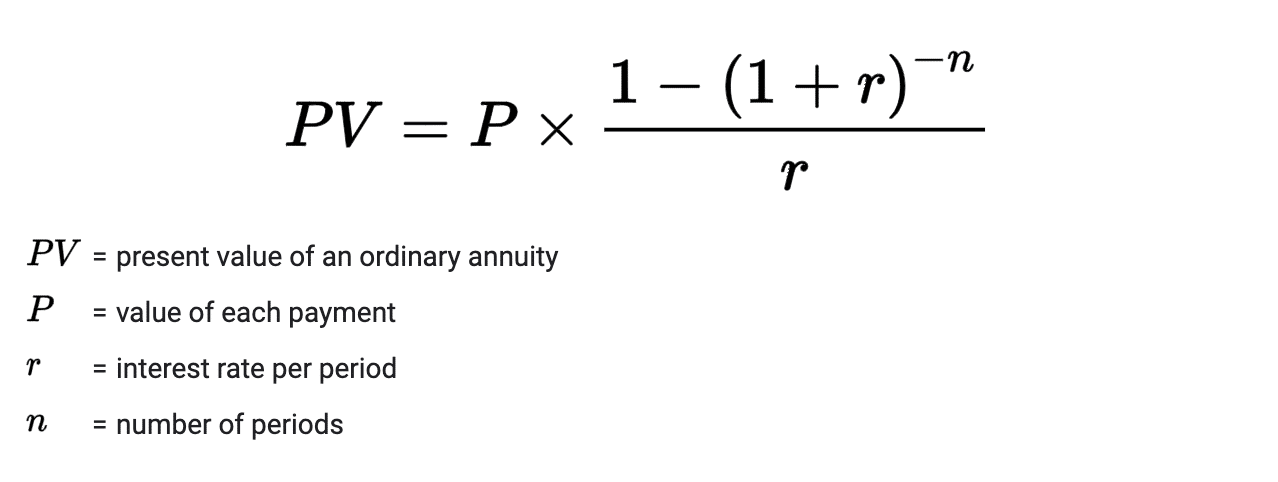

Stands for the amount of each annuity payment r. Explanation of PV Factor Formula. But you will need this present value calculator to plan your childs education or any other major expenses or purchases.

FV Pmt x 1 i n - 1 i. Or Ideal Life Cover is a number that tells the present value of future income expenses. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest.

Where is the number of terms and is the per period interest rate. Once the annuitization or distribution phase begins again based on the terms of your. Deferred payments are by far the most popular type in the United States and they are the best choice for an investor who doesnt need instant income from an annuity.

Stands for the Interest Rate n. Figure Out the Net Present Value of an Annuity. Present Value of an AnnuityC11ini where C is the cash flow per period i is the interest rate and n is the frequency of payments.

Human life value Calculator - HLV calculator helps you calculate the life insurance needs and term life cover amount. PaymentWithdrawal Frequency The paymentdeposit frequency you want the present value annuity calculator to use for the present value calculations. Stands for the number of periods in which payments are made The above formula pertains to the formula for ordinary annuity where the payments are due and made at the end of each month or at the end of each period.

That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate.

Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. An annuity is a financial instrument that accrues interest on a tax-deferred basis and protects against market risk and longevity risk.

The purpose of the future value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. They provide the value at the end of period n of 1 received at the end of each period for n periods at a discount rate of i. Stands for Present Value of Annuity PMT.

The future value of an annuity formula is. In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental. 5000 it is better for Company Z to take Rs.

Present Value Of An Annuity. In essence when you buy a deferred annuity you pay a premium to the insurance company. Immediate Life Annuity- Rs87 527 Immediate life annuity with return of purchase price- Rs206155 Deferred life annuity with return of purchase price-Rs108303 Max-no limit Disclaimer.

Read more of Present Value of an Annuity. Policybazaar does not rate endorse or recommend any specific insurance provider or insurance product offered by any insurer. A regular-pay deferred annuity plan that helps you gradually build the retirement savings and provide guaranteed income for life.

The interval can be monthly quarterly semi-annually or. As present value of Rs. A deferred annuity is an insurance contract that generates income for retirement.

Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. The future cash flows of. 5500 after two years is lower than Rs.

Because annuities offer many benefits lottery winners retirees and structured settlement recipients use them to create predictable cash flow for the present future and even after their death. Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow.

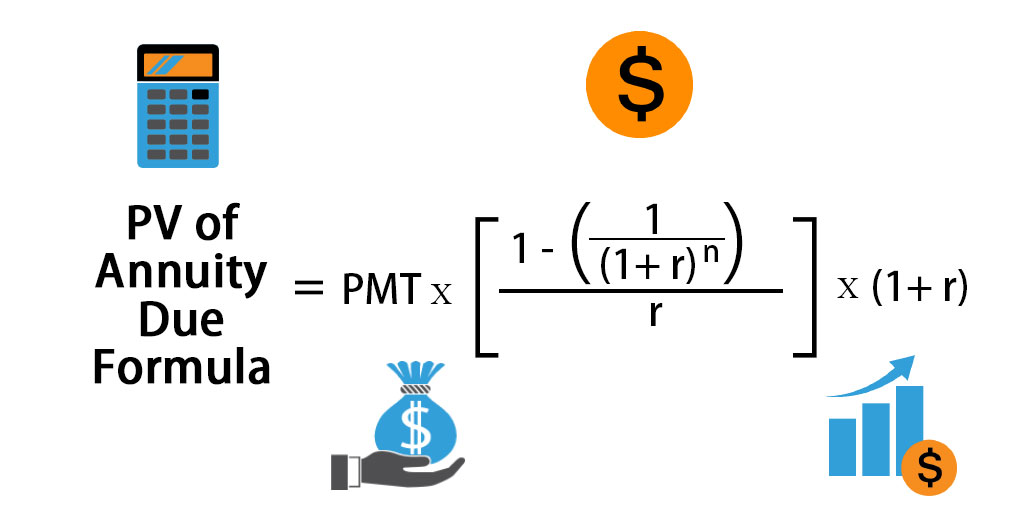

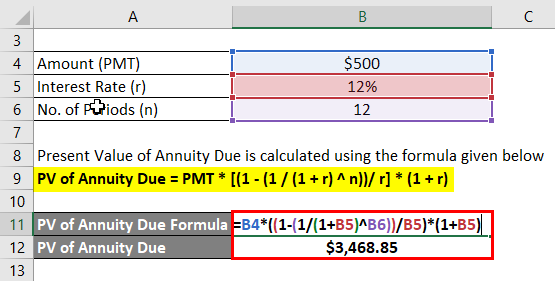

Present Value Of Annuity Due Formula Calculator With Excel Template

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

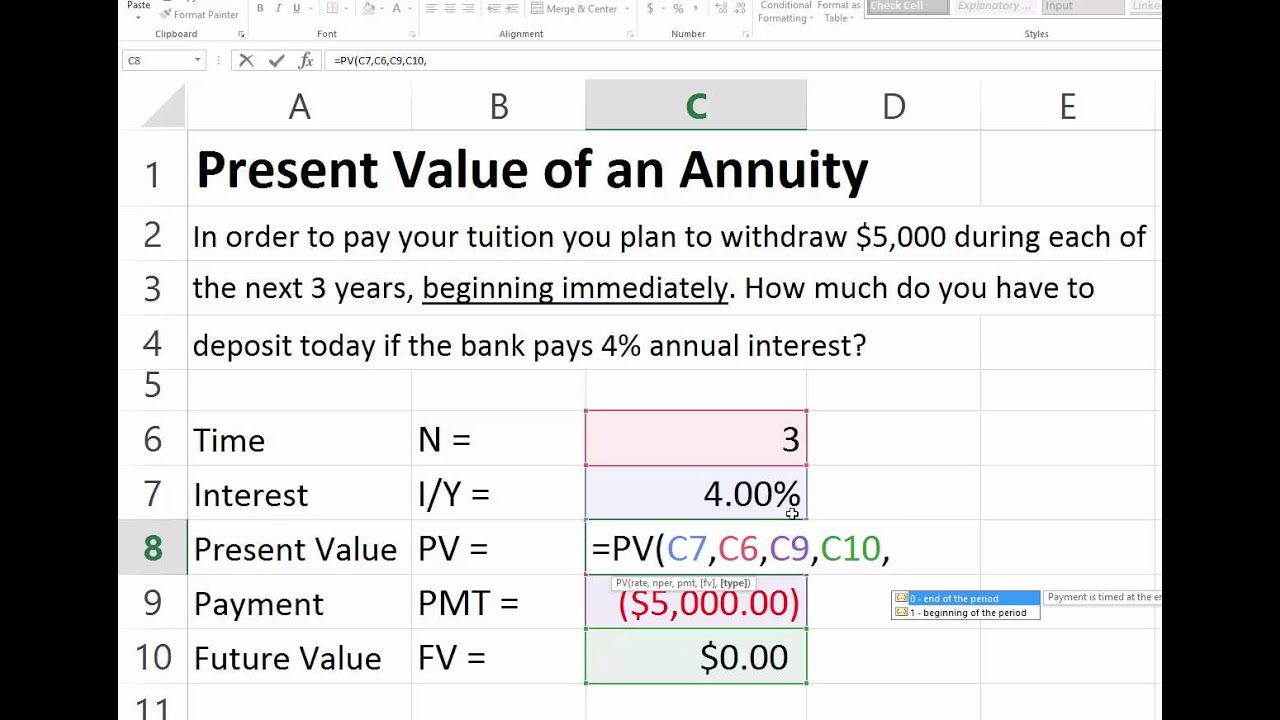

Finding The Present Value Of An Annuity Due In Excel Youtube

Present Value Of Annuity Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of Annuity Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

How To Measure Your Annuity Due

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of Annuity Formula Double Entry Bookkeeping

Present Value Annuity Tables Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

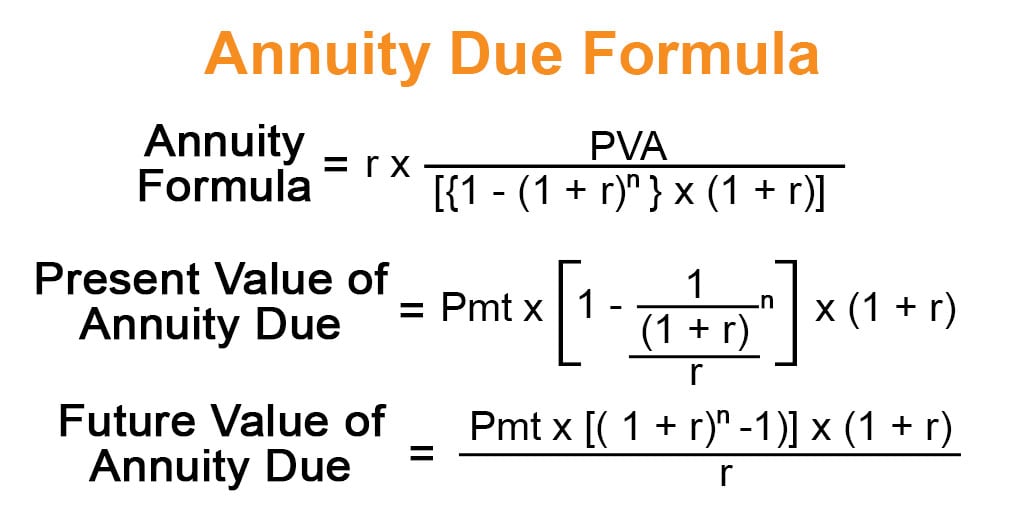

Annuity Due Formula Example With Excel Template

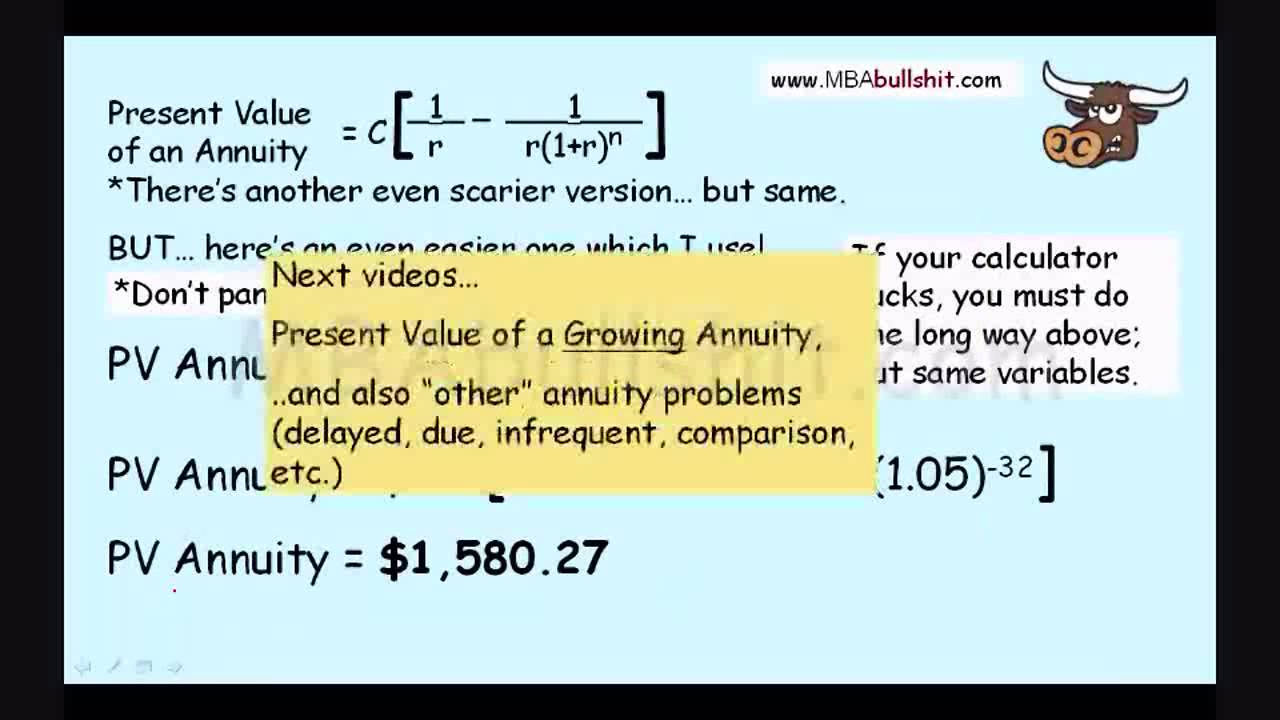

How To Calculate The Present Value Of An Annuity Youtube

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Annuity Calculation In 9 Minutes Annuities Explained For Present Value Of An Annuity Formula Youtube